Market rent is the amount of rent expected for use of a property based on comparables or “comps.” But what does that mean in practice for apartment community managers, and most importantly, how can managers make sure they are working with accurate information, so they don’t miss the mark on pricing rents competitively while still staying reasonable in their expectations?

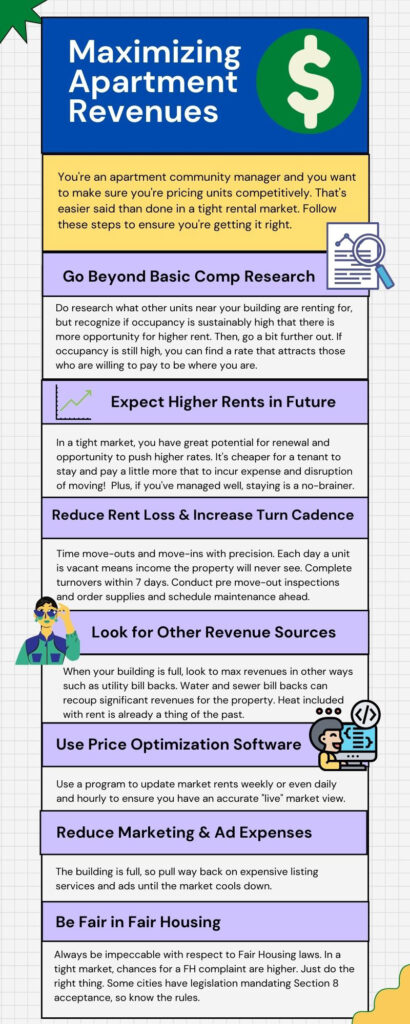

Researching or “shopping comps” is simply data collection with the goal of knowing where to price units. Every professional manager understands that their revenue management is data driven. So, to maximize revenue we need to know the baseline and determine ways to increase it, if possible. This can get especially challenging when supply is low or you’re in a “tight” rental market. In that case, a deep dive into comps is essential so that money is not left on the table.

“Staying focused on market surveys and other issues affecting the market will help property managers navigate changing rents and keep their buildings strong economically.”

The geographic location of the property is the leading factor when seeking comps.

The question to ask is what are other rents relative to the location? Based on geography, you might think that you’d make a quick price per square foot calculation and you’re done. But, not so fast. The savvy, competitive manager knows it’s so much more. The savvy manager knows when inventory becomes thin, there are fewer real comps. Getting rates from buildings sitting full is no longer an accurate depiction of what a unit will rent for in the open market. While managing 11 different assets, I learned this in the vortex of one of the country’s hottest rental markets.

In 2009, I moved from Cleveland to Portland, Oregon. When I started working in multi-family housing, I had no idea that Portland was about to experience an unprecedented boom to its housing market. By 2011, there was a clear trend that young people, like me, were flocking to Portland. It was the hottest market of all major west coast cities due to both affordability and livability. People with enterprising spirit and modern ideas along with tech startups galore were moving-in in droves. My office phone rang day and night with calls coming from California, Pennsylvania, and Idaho area codes. It’s no wonder when you realize 400,000 people moved to Portland between 2009 and 2019.

“… I could see the trend and the area quickly going down to zero availability. Coupled with my own desire to live in that area, I recognized that the comps on the survey were reflective of existing rates and not true market rates.”

Our management focus had to shift from marketing – we didn’t have to advertise units – toward working around the clock managing demand. It’s no exaggeration to say that renters were banging on the doors. Existing properties certainly could not meet the demand and there was no way developers could build fast enough to meet the need for 35,000 new units each year. Local and regional governments were ill-prepared to govern in the dramatically changing environment and just keeping pace was overwhelming.

By 2011, I was overseeing a small portfolio of apartment complexes. One of the complexes was close-in within the southeast part of the city. Simultaneous with watching the neighborhood change quickly, I was looking over a market survey to check rent comps in-line with our buildings, but I could see the trend and the area quickly going down to zero availability. Considering my own desire to live in that area, I recognized that the comps on the survey were reflective of existing rates and not true market rates. The true market rates were wildly inflated, but buildings were easily commanding those rates. In that era of crazed demand, savvy property managers gained market share with dramatically increased rates and profit.

Later in my own Portland story, I worked for a larger company that offered third-party management to several ownership groups. I was one member of a highly committed team focused on maximizing revenue using data-driven practices and reacting and evolving operationally. It was another great learning curve and provided fascinating perspective on the mechanics of revving up operations. The point is, pivoting with new tactical points in high-demand markets achieves results.

It’s important to note that the extremes of the Portland experience aren’t likely to happen in most markets. And, in situations like that, the game changes. You need to switch gears when the market changes. Well-performing, stable assets are wonderful to manage making upkeep no problem, improvements easy to budget, and residents happy. When you have happy residents you have high rates of retention, which eases workload on staff. The operation can run like a well-oiled machine when the revenue is maximized.

“Every day a unit is vacant means income the property will never see.”

Now, as I watch submarkets here in Northeast Ohio grow tight, especially including Lakewood, Cleveland Heights, downtown and even extending south into Highland Square in Akron, I wonder if the Cleveland area will go the way of Portland? While we aren’t seeing a mass influx from elsewhere, we are seeing single-family property values soar, which is pricing many renters out of the home-buying market. In addition, data shows Gen Y and Z to be less interested in homeownership than generations past. Instead, these generations are focused on convenience and lifestyle amenities. So, I think it’s important to recognize comparable trends, expressly when your goals are to increase revenue and performance of an asset.

Some projections and things to be mindful of:

- Higher Rents The market can wholly determine the rate at vacancy. Existing rates will not provide good data, but testing up to see what true market while tolerate is the way to go. Low inventory means existing rates can also climb at renewal.

- Lease Renewal and Expiration Management These processes can serve to push existing rates more aggressively and expirations must be methodically timed to minimize down time. Premiums for short-term lease extensions are standard and on the rise.

- Rent Loss due to Vacancy When a new tenant is waiting to move in, the clock is ticking for the property. Each day a unit is vacant means income the property will never see. Site staff must understand that lost rent days are unrecoverable. How long should a ready unit be held? In a competitive market, renters are willing to become rent responsible sooner to secure their space, so keep that in mind when pre-leasing.

- Turn Cadence Implementing a turn cadence to minimize rent loss due to vacancy is essential. Apartment turnovers should ideally complete in less than seven days. Conduct pre-moveout inspections and then order supplies well-ahead of time and schedule vendors and maintenance. Doing so is a best practice in management and can reap major financial benefits.

- Turn Cost This is a top dollar item in any site’s budget. Supply chain issues and inflation have created a serious uptick in expenses so dialing in turn costs through material and vendor selection, and value assessment is essential. This is where good retention efforts pay off and can really help you save a lot.

- Look for Other Sources of Revenue Is money being left on the table? Where permitted, utility bill backs for water, sewer, and heat – if not individually metered – is a great way for a landlord to recover cost. Savvy management will also ensure that pet rent, parking and storage costs remain competitive.

- Use of Price Optimization Software In the data driven landscape, there are commonly used price optimization applications. These programs will update market rents daily, and in some cases hourly to ensure an accurate “live” market rate.

- Reduce Advertising and Marketing Expenses By reallocating budgeted resources to tenant retention efforts, costs are reduced and revenue is maximized. When the building is full, focus on retention and you will dramatically lower costs.

These are just a few things on the horizon that will complicate market rent in various submarkets of Northeast Ohio in the coming year. Staying focused on market surveys and other issues affecting the market will help property managers navigate changing rents and keep their buildings economically strong. The things to focus on especially in the coming months will be overall revenue management, through reliance on good data for comps and pricing, and optimizing asset performance with cost savings and reduced turn times.